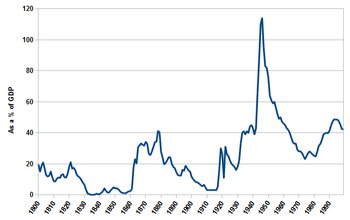

Look at the graph: US debt nearly doubled during Clinton 8 years from 3 trillion to nearly 6 trillion, doubled during Bush JR 8 years. during the first Obama years it went up from 10 trillion to 14 trillion. It would tripple if it continues at this rate. we have to place tariffs on foreign products now. Free trade has been bankrupting this nation during all of administrations: Clinton, Bush and particularly insane Obama

Posted on | January 7, 2011 | No Comments

United States public debt

|

| Part of a series on: |

| U.S. Budget & Debt Topics |

|---|

| v · d · e |

U.S. debt from 1940 to 2009. Red lines indicate the Debt Held by the Public (public debt) and black lines indicate the gross debt, the difference being that the gross debt includes funds held by the government (e.g. the Social Security Trust Fund). The second chart shows debt as a percentage of U.S. GDP or dollar value of economic production per year. Data from U.S. Budget ‘ tables at whitehouse.gov/omb and other tables listed when you click on the figure. Note that the top panel is deflated to 2009 dollars and not in nominal year dollars.

The United States public debt is a frequently reported measure of the obligations of the United States government and is presented by the United States Treasury in two components and one total:

- Debt held by the public, representing U.S. Treasury securities held by institutions or individuals outside the United States Government;

- Intragovernmental holdings, representing Federal government obligations for specified programs, such as Social Security; and

- Total public debt outstanding, which is the sum of the above components.[1]

As of December 31, 2010, the “Total public debt outstanding” was $14.0 trillion and was approximately 99.3% of 2009’s fiscal year-end annual GDP of $14.1 trillion, with the “Debt held by the Public” at approximately 66.7% of GDP ($9.4 Trillion) and “Intragovernmental holdings” standing at 32% of GDP ($4.6 Trillion).[2][3][4] Using 2009 figures, the total debt (86.1% of GDP) ranked 12th highest against other nations, while the component “Debt held by the Public” (53.5% of GDP) ranked 41st.[5]

The national debt should not be confused with the trade deficit, which is the difference between net imports and net exports. State and Local Government Series securities, issued by state and local governments, are not part of the United States government debt.[6]

The annual government deficit or surplus refers to the cash difference between government receipts and spending ignoring intra-governmental transfers. The gross debt increases or decreases as a result of this unified budget deficit or surplus. However, there is certain spending (supplemental appropriations) that add to the gross debt but are excluded from the deficit. The total debt has increased over $500 billion each year since fiscal year (FY) 2003, with increases of $1 trillion in FY2008, $1.9 trillion in FY2009, and $1.7 trillion in FY2010.[7]

Contents[hide] |

[edit] History

The United States has had public debt since its inception. Debts incurred during the American Revolutionary War and under the Articles of Confederation led to the first yearly reported value of $75,463,476.52 on January 1, 1791. Over the following 45 years, the debt grew, briefly contracted to zero on January 8, 1835 under President Andrew Jackson, but then quickly grew into the millions again.[8]

The first dramatic growth spurt of the debt occurred because of the Civil War. The debt was just $65 million in 1860, but passed $1 billion in 1863 and had reached $2.7 billion following the war. The debt slowly fluctuated for the rest of the century, finally growing steadily in the 1910s and early 1920s to roughly $22 billion as the country paid for involvement in World War I.[8]

The buildup and involvement in World War II plus social programs during the F.D. Roosevelt and Truman presidencies in the 1930s and ’40s caused a sixteenfold increase in the gross debt from $16 billion in 1930 to $260 billion in 1950.

After this period, the growth of the gross debt closely matched the rate of inflation where it tripled in size from $260 billion in 1950 to around $909 billion in 1980. Gross debt in nominal dollars quadrupled during the Reagan and Bush presidencies from 1980 to 1992. The Public debt quintupled in nominal terms.

In nominal dollars the public debt rose and then fell between 1992 and 2000 from $3T in 1992 to $3.4T in 2000. During the administration of President George W. Bush, the gross debt increased from $5.6 trillion in January 2001 to $10.7 trillion by December 2008,[9] rising from 58% of GDP to 70.2% of GDP. Under the Obama administration, starting in March 2009, the Congressional Budget Office estimated that gross debt will rise from 70.2% of GDP in 2008 to 100.6% in 2012.[10]

| Year | Gross Debt in Billions undeflated[11] | as % of GDP | Debt Held By Public ($Billions) | as % of GDP |

|---|---|---|---|---|

| 1910 | 2.6 | unk. | 2.6 | unk. |

| 1920 | 25.9 | unk. | 25.9 | unk. |

| 1928 | 18.5[12] | unk. | 18.5 | unk. |

| 1930 | 16.2 | unk. | 16.2 | unk. |

| 1940 | 50.6 | 52.4 | 42.8 | 44.2 |

| 1950 | 256.8 | 94.0 | 219.0 | 80.2 |

| 1960 | 290.5 | 56.0 | 236.8 | 45.6 |

| 1970 | 380.9 | 37.6 | 283.2 | 28.0 |

| 1980 | 909.0 | 33.4 | 711.9 | 26.1 |

| 1990 | 3,206.3 | 55.9 | 2,411.6 | 42.0 |

| 2000 | 5,628.7 | 58.0 | 3,409.8 | 35.1 |

| 2001 | 5,769.9 | 57.4 | 3,319.6 | 33.0 |

| 2002 | 6,198.4 | 59.7 | 3,540.4 | 34.1 |

| 2003 | 6,760.0 | 62.6 | 3,913.4 | 35.1 |

| 2004 | 7,354.7 | 63.9 | 4,295.5 | 37.3 |

| 2005 | 7,905.3 | 64.6 | 4,592.2 | 37.5 |

| 2006 | 8,451.4 | 65.0 | 4,829.0 | 37.1 |

| 2007 | 8,950.7 | 65.6 | 5,035.1 | 36.9 |

| 2008 | 9,985.8 | 70.2 | 5,802.7 | 40.8 |

| 2009 | 12,311.4 | 86.1 | 7,811.1 | 54.6 |

| 2010 (31 Dec) | 14,025.2 | 95.2 (3rd Q) | 9,390.5 | 63.7 (3rd Q) |

[edit] Components

Comments

Leave a Reply

29839 Sta Margarita Pkwy,

29839 Sta Margarita Pkwy,

Videography by Barbara Rosenfeld

Videography by Barbara Rosenfeld